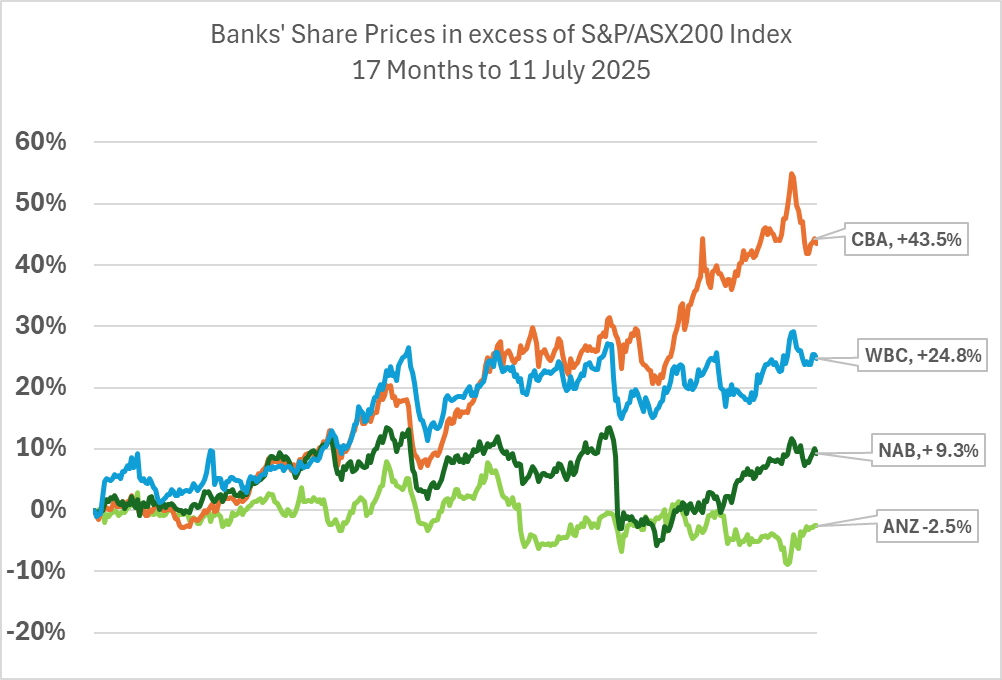

The extreme rise in the share price of the major Australian Bank CBA over the past 18 Months (compared to the 3 other big Banks) has caused ripples of concern for superannuation fund chief investment officers (CIOs) who have been underweight this stock which makes up about 10% of the Australian shares index .

Since mid-February 2024, when CBA’s meteoric rise started, its share price rise relative to the S&P/ASX 200 Index was +43% compared to ANZ -2.5%, NAB +9.3% and WBC +25%. This has implications for superfunds which must perform in line with market weighted indexes over 2 years or close to new business.

I explore this issue further in this week’s Blog Insight which you can access HERE

You can read a recent CIO interview in the Australian Financial Review HERE

Learn more about government performance tracking with the APRA item HERE